PayPal Charge in India with USD to INR Examples

PayPal is top payments option in India, but most of Indian people hate them, because they charge more fees compare to Payoneer. Here I will share one example, how much they charges for a specific amount. Most of times when you asked them like how much Indian rupees you will get if you receive $200 from any company, then they don’t reply with exact amount number, so at that time, you can use my example to understand it. Mainly they charges in two ways.

1. PayPal fixed fees: When you receive a payment

For this, we can see currently they are charging $4.4 % + Fixed price ($0.30) + GST(18%). The rate might be changed in future, so please refer above link to know the exact number.

2. PayPal currency convergence fees: When you withdraw money to your local bank.

Currently they are charging 2.5 % on currency conversion fees, but there is some hidden charges which PayPal apply. In reality they don’t disclose that rate, normally they said they are partner with some banks, and their rate is normally lower than what xe.com website display. For example if the rate is 64 USD then their partner bank gives them 63.2 USD, and then PayPal apply again 2.5% currency convergence fees. So the approx currency convergence fees is 3.8% in my opinion.

Example to know PayPal charges in India - Convert $200 USD to INR

1. PayPal Transaction fees (+ 18% GST)

= 4.4 % of Amount + 0.30 as fixed price + 18% GST on fees

= 200 - 4.4 % + 0.30 + 18% GST on fees

= 8.8 + 0.30 + 18% GST on fees

= 9.1 + 18% GST on fees

= 9.1 + (9.1 - 18%)

= 9.1 + 1.638

= 10.738

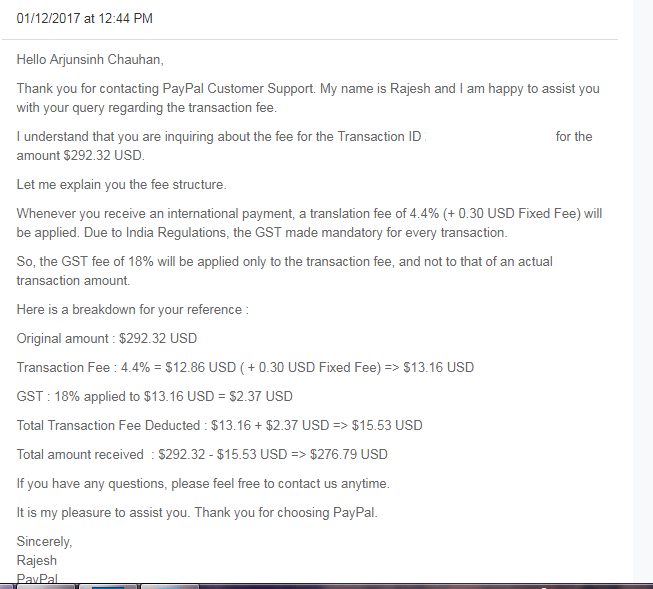

Here is screenshot from paypal support, if you want to take a look.

So the actual amount will remain in your PayPal account is 200-10.738=189.262 USD. Now if you want to withdraw that amount in your local bank (Which is automatically done for all Indian PayPal users as per RBI new rule) then currency fees will apply, so let’s continue our calculation.

2. PayPal Currency convergence fees

Here, we take 1 USD = 64.38 as a example, you’re free to check current rate on any site, so let’s apply 3.8% currency convergence fees (2.5% paypal currency converge fees + their partner bank fees)

= 64.38 - 64.38-3.8%

= 64.38 - 2.44

= 61.94

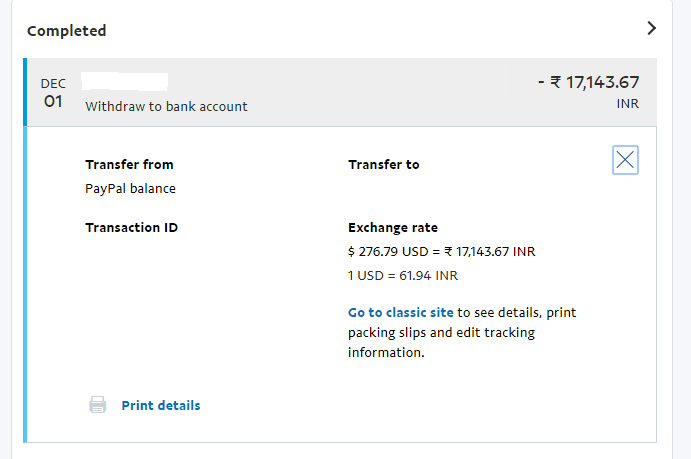

Here is screenshot of their rate when they withdraw to my bank account.

So PayPal will use 61.94 rate when they transfer your remaining PayPal money to your local bank. Now let’s calculate the final amount that you will receive in your bank account.

= 189.262 * 61.94

= 11722 INR

So this is the approximately money you will get in your local bank. Now here if we do simple maths then we will get 11722/200 = 58.61 rate, so in reality PayPal total approx fees is 9%. It means whenever you want to do some quick calculation then do it directly like 64.38 - (64.38-9%) = 64.38- 5.7942 = 58.58. And then multiple your USD amount like 58.58 * 200 = 11716

I personally use Payoneer to receive money, because their rate is very cheap compare to PayPal. Talk to your payer if they can pay via Payoneer, I bet you won’t disappoint. Also if you create a new account right now (using this link), then you will get $25 bonus as a free signup, that bonus you can withdraw to your bank anytime once you receive total of $100 from anyone. So signup now and talk to their customer care support if you have any question regarding free bonus or charges rate.